YOUNGSTOWN, Ohio – While skyrocketing energy prices have forced households to trim their budgets, they’ve also meant higher royalty checks to Columbiana County landowners with acreage tied to producing oil and natural gas wells.

Energy companies have also stepped up leasing activity in the county over the last year and a half, a sign that interest in this section of the Utica Shale/Point Pleasant formation remains very much alive.

For these landowners, higher prices represent a reversal of fortune compared with two years ago, when the oil and gas market bottomed out during the pandemic. Even last summer, landowners griped that royalty payments remained well below the levels that big companies such as Chesapeake Energy Corp. promised when they swept into the region more than a decade ago.

Today, these landowners say payments have noticeably improved and are more in line with rising energy costs.

“The royalties have bounced up. They’ve more than doubled,” says Cynthia Koonce, a sheep farmer in Guilford Lake. Koonce has 225 acres tied into the Huffman South well nearby, while another 1½ acres are tied to the Huffman North well.

Chesapeake drilled both wells but they are today owned by Houston-based Encino Energy’s exploration subsidiary, EAP Ohio. In 2018, Encino acquired the remaining stake of the Chesapeake position in eastern Ohio, which included 900 wells and nearly one million leasehold acres.

At one point in 2019, Koonce says, royalty payments had collapsed from an average of $2,000 to $3,000 per month to less than $400. Since last September, however, payments have risen. “Now they’re more than what they were before,” she says.

She attributes the heftier royalties to higher commodity prices for oil and gas, not increased volume from the wells. “It’s primarily gas coming out of the well,” Koonce says. “It pays the mortgage, which is good from my point of view.”

Other landowners have experienced the same results.

Jeffrey Dick, a geology professor at Youngstown State University who has acreage under lease with Houston-based Hilcorp Energy Co., says his royalty checks have more than doubled since last year. “They started to increase about eight months ago,” he says.

He says it’s harder today to measure drilling activity or production in terms of rig counts or permits compared to 10 years ago. Then, energy companies descended on eastern Ohio in a frenzied effort to lock up leasehold acreage and kickstart drilling programs by putting as many rigs into commission as possible. Technology, however, has allowed companies such as Encino and Hilcorp to operate more efficiently with fewer rigs in the field.

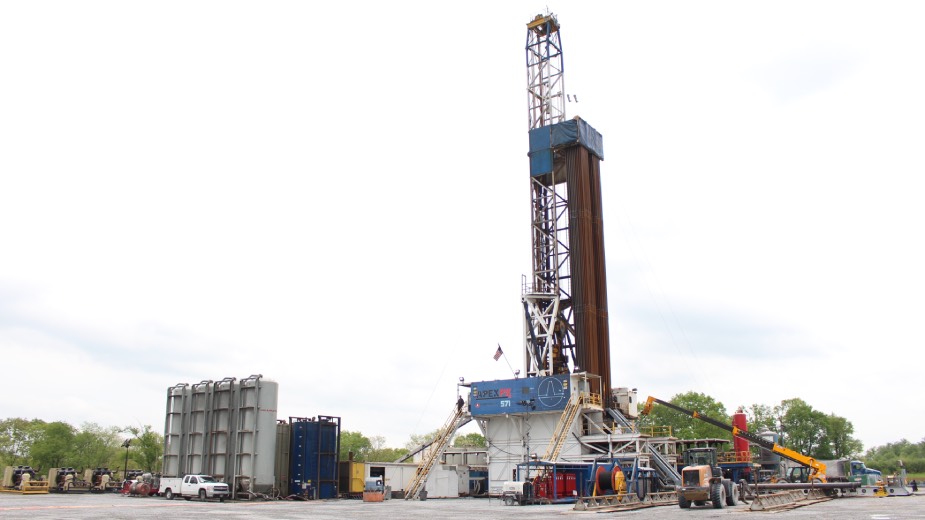

Energy companies have combined horizontal drilling with hydraulic fracturing to tap into tight shale formations such as the Utica/Point Pleasant. Rigs are able to drill about 6,000 feet deep and then turn the drill bit horizontally across a thin layer of carbon-rich shale.

Dick says these companies have figured out how to maximize production from a single well by drilling longer laterals. They have also been perfecting hydraulic fracturing techniques – a method that uses water, sand and chemicals under high pressure to break up shale and coax long-trapped oil or gas to the surface. Moreover, technological advances enable companies to drill more laterals and longer laterals from a single well bore.

“It’s making a difference,” Dick says. Hilcorp, for example, is simultaneously fracking two wells on a well pad not far from his house.

Leasing activity has also picked up over the past year, says Alan Wenger, an oil and gas attorney at Harrington, Hoppe & Mitchell in Youngstown. “It’s started to ramp up. I’m sensing more activity now,” he says.

Landowners stand to negotiate better terms on leases in a higher price environment for oil and gas, Wenger says. In 2015, when many of the initial leases with companies such as Chesapeake were renewed, the terms were far less satisfactory.

“Companies were getting away with mediocre terms,” Wenger says. “The royalty rates now are better than in 2015.”

Those signing new leases are on average likely to negotiate royalties that hover between 16% and 19% of a well’s gross production, Wenger says. In more productive tiers of the Utica – especially in the southeastern portion of the state – those royalties could top more than 20%.

Energy companies are also willing to shell out a new round of upfront bonus payments to landowners based on the amount of acreage proposed under the lease, Wenger says. In Columbiana County, he’s seen one-time bonuses of $1,000 to $1,500 per acre.

While this is substantially lower than the $5,000 to $6,000 per acre that energy companies awarded landowners during the initial dash to the Utica, it’s still an improvement from five years ago.

In more lucrative areas of the southern Utica where some of the most productive wells sit – Jefferson and Harrison counties, for example – bonuses have approached the $5,000 mark, Wenger says. “Most of them aren’t as good as 2010. But they’re getting there,” he says.

Recently, the Muskingum Watershed Conservancy District reached an agreement with Encino to lease 7,300 acres at Tappan Lake in Harrison County.

The five-year contract calls for Encino to drill at least 15 wells during that period with more wells completed during an optional three years thereafter.

The Muskingum Watershed would receive $5,500 per acre, paid over five years, and gross royalty payments of 20%. The lease is a nonsurface lease meaning Encino will not construct well pads or other heavy infrastructure on MWCD property.

“We are happy to continue our partnership with Encino Energy,” said Craig Butler, MWCD executive director. “They are very committed to our operational and environmental principles, as well as investing in the region.”

Encino and its subsidiary, EAP Ohio, is the most active energy company engaged in Columbiana County, records show. Since Jan. 1, 2021, EAP has sewn up 262 new or renewed leases, most of them in Washington, Butler and Yellow Creek townships, according to public records. In 2020, the company negotiated just 44 leases.

Hilcorp, the other active driller in Columbiana County, negotiated 15 leases between Jan. 1, 2021, and May 25, 2022, mostly in Fairfield and Elk Run townships. In 2020, the company signed 68 leases, records show.

“We’re cautiously optimistic about developing the northern Utica,” says Jackie Stewart, spokeswoman for Encino Energy. “We’re the most active producer in Columbiana County. So we’re really excited.”

Stewart says the company is in various stages of drilling four wells in the county. Among them is the Maskaluk CL well in Washington Township. Two other rigs are in commission in Carroll and Harrison counties.

“We maintain a consistent, long-term approach to development,” Stewart says. “Even during the pandemic, when oil prices were negative, we had two rigs going the whole time.”

Encino’s Ohio operations employ 140 and the company is hiring. “We also support thousands of local contractors who continue to tell us they need more employees, specifically truck drivers,” she says.

Among suppliers to the company is pipe and tube producer Vallourec. The Vallourec operation in Youngstown manufactures steel casings for Encino. The global pipe and tube producer recently reported that revenue from oil and gas operations in North America nearly tripled during the first quarter of 2022. “They are also hiring,” Stewart says.

George Brown, executive director of the Ohio Oil and Gas Energy Education Program, projects that oil and gas exploration across the eastern portion of the state should continue to grow. “Overall, the outlook of the industry is stable,” he says. “You’re going to see continued growth and activity.”

Producers use more efficient rigs that enable these companies to explore other areas of the Utica/Point Pleasant, Brown says, that were perhaps initially marginalized. “They know we have the resources here,” he says. “We do it safer, cleaner and better than anyone else on the planet.”

If there is one major concern among producers, it’s that the industry requires more pipeline infrastructure to transport oil and gas across the country, Brown says.

“There are five pipeline projects that would take gas out of the Appalachian basin to the east and south that have been held up,” he says. There is also the need to build additional export terminals.

“There’s definitely a need for that,” Brown says. “It doesn’t do any good if we get it out of the ground and can’t send it anywhere.”