Cortland Bank Helps First-Time Homebuyers Put Down Roots

YOUNGSTOWN, Ohio – When it comes to fostering a sense of community, there’s little that’s better than homeownership, says Mark Chuey.

“Renting just doesn’t create the same anchor that homeownership does,” says the Cortland Bank vice president and retail mortgage banking officer.

“It’s a shared experience, the emotion and the commitment to the risk that you’re taking to purchase a home,” he continues. “I don’t think there’s anything like doing repairs on your house or maintaining it and sharing that with someone else.”

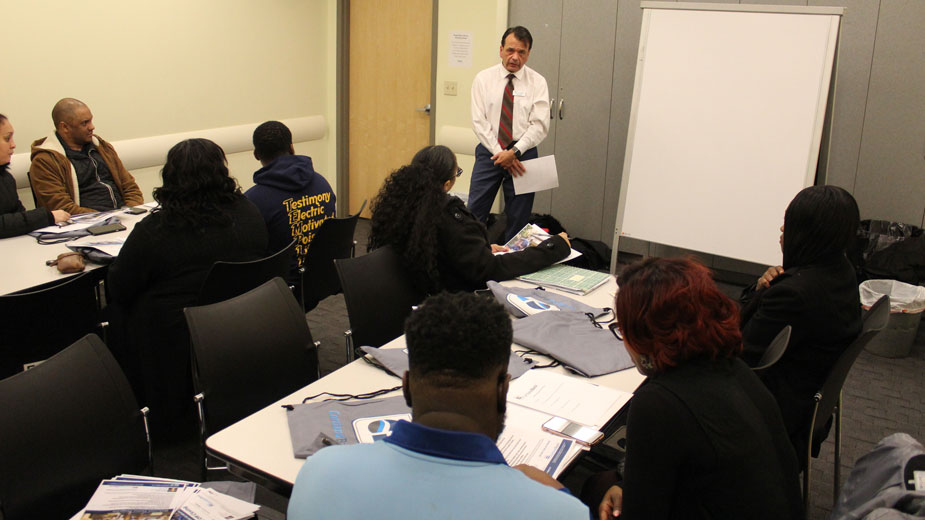

Thursday evening, Chuey led an information session aimed at educating would-be homebuyers on what to expect as they work their way through the process. For many in attendance, they wanted to be homeowners for the same reasons Chuey detailed: a connection to their community.

“Being part of a community helps our kids. They have a lot of extracurricular activities, so it’s huge for us,” says Sonya Marshall, principal at Warren City Schools’ Jefferson PK-8. “Having been gifted my childhood home and my fiancee having a home, I want to continue showing our children what it means to be a homeowner. It’s not just a big part of being a community, but it’s part of our family. Our entire family are homeowners, so it’s continuing a tradition between both our families.”

She attended the event with her fiancee, Tedric Washington. The couple has three kids and more space is necessary, they say. Since the couple got engaged six months ago, they’ve been looking into what they’ll need to buy. Buying a home, Washington says, was one of the first discussions they had after their engagement.

“It was important for both of us. We’ve been on the same page as we’ve gone through it,” he says.

Likewise, having space for a growing family is what’s pushing Jessica Driscoll-Owens to search for a home.

“Rent prices have gone up a lot recently and for what I’m paying, I’m sure I can get a decent house,” says the community relations manager for Beatitude House. “I want to be a bigger part of the community and have something that I own where I can expand my family.”

Further developing that sense of community, Chuey says, is the presence of community groups such as the Northside Citizens Coalition.

“Youngstown is very, very affordable. It has a lot to offer and will have a lot to offer in years to come. Part of the attraction is it’s affordable, there’s a premier university, all the shopping, the hospitals and it’s close to Cleveland and Pittsburgh,” he says. “But the most important thing is that cooperation between the city of Youngstown and community groups.”

Oftentimes, Chuey says, the biggest barrier for first-time homebuyers is coming up with the funds for a down payment. In that regard, there are plenty of aid programs available, but it often falls onto buyers to discover them. And without the prior knowledge of working through the process, many first-time buyers don’t know where to look.

“They’re elusive. You have to do the work, but they are out there,” he says. “The thing that holds most people back in terms of buying a home for the first time is the down payment. They can’t save it up. Having that assistance is a huge help.”

Among such programs is Cortland Bank’s Welcome Home program, funded through the Federal Home Loan Bank of Cincinnati. Available March 2 on a first come-first served basis, the program provides up to $5,000 in down payment assistance. The program is not limited to first-time buyers, but does have income caps: $56,720 for households of one and two people and $65,228 for households of three or more. Buyers must also contribute at least $500 toward down payment and closing costs.

Cortland Bank also offers the Community First program, which provides up to 5% of the loan amount for down payment assistance. Similar programs are also available through Catholic Charities, Community Action Agency of Columbiana County and the city of Campbell for houses within city limits.

“They’re all tailored to people buying a home for the first time, though you don’t have to be a first-time buyer. [It’s aimed at] people looking to buy something in the affordable lending bracket, so income comes into play,” he says.

The bank also has several loan programs to cater to all types of buyers, offering both conventional and government-backed loans such as those through the Federal Housing Administration, U.S. Department of Agriculture and Veterans Affairs.

In-house, Cortland Bank has its own portfolio loan program that offers loans for 3% down, no private mortgage insurance and is available at a minimum credit score of 600 rather than the usual standard of 640.

“It doesn’t have to abide by the traditional agency guidelines from Fannie Mae or Freddie Mac. Cortland Bank tailored its guidelines to those in the low- to moderate-income bracket,” Chuey says. “It has a lot of advantages to get people into their home. We don’t offer it for sale on the secondary market. We keep it in-house. It’s a loan we carry on our books.”

But before any potential buyer starts looking for a home, he says there’s one question that ought to be addressed first: “Should I buy a home now?

“Not if they qualify or what they’re credit is like or if they have the down payment money, but what their personal plans and goals are for the next three to five years,” Chuey says. “How flexible are they? You have maintenance and things like that. Real estate prices go up and they go down. It can be nerve-wracking to experience that for the first time and they don’t look at it like a traditional investment.”

Pictured: Cortland Bank vice president Mark Chuey led an information for first-time homebuyers.

Copyright 2024 The Business Journal, Youngstown, Ohio.