NHA Solves Quaker Manufacturing’s Employee Benefit Problem

At the Quaker Mfg. Corp. in Salem, the director of human resources, Teresa Reckner, faced a significant time management problem.

Reckner, who describes herself as “a one-woman HR department,” is responsible for handling everything from insurance to safety training compliance, payroll, orienting new hires and keeping the staff of 125 full-time and 30 temporary employees up to strength. This process once involved significant paperwork, data entry and, above all, time she could have spent on other tasks.

Reckner reached out to Dee McFarland, an employee-benefits account administrator with whom she once worked, to help solve some of her problems.

McFarland offered Reckner solutions to help her with new-employee orientation and problems with payroll. She had just assumed a new role as an employee-benefits consultant for National Healthcare Access, a Boardman company dedicated entirely to employee benefits.

“When I started working with National Healthcare Access, we were very technology driven. And that’s when we went down the road of trying to streamline the benefits and bring them into the 21st century,” McFarland says.

“The employee-benefits world is very antiquated. In our industry, we like to say the insurance carriers are dinosaurs and we’re trying to change that perception and change that for our clients in the Valley.”

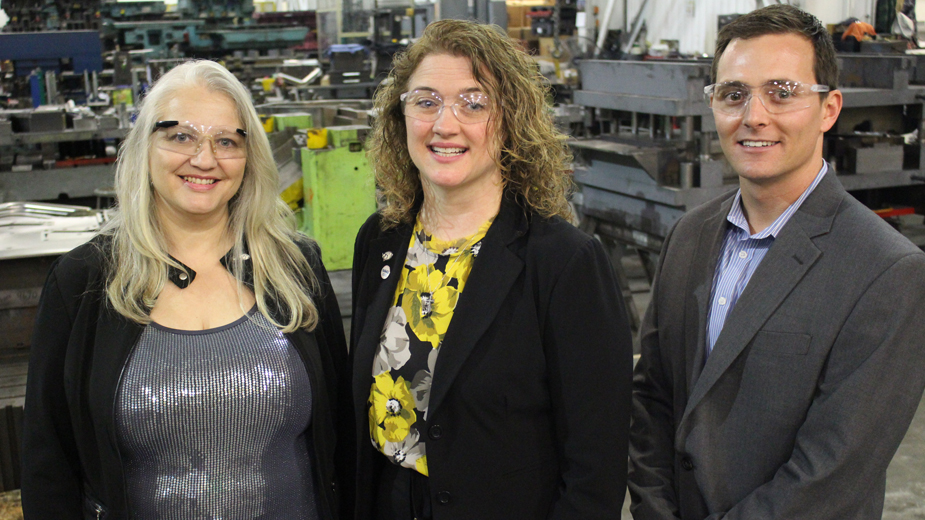

Pictured: Teresa Reckner turned to Dee McFarland and Dan Caparso to streamline HR tasks.

Pictured: Teresa Reckner turned to Dee McFarland and Dan Caparso to streamline HR tasks.

McFarland connected Reckner with NHA’s Navigator system, which provides a centralized management console and employee portal that allows HR professionals to easily streamline their operations. Quaker integrated the Navigator system into its cloud-based payroll system, Paylocity. NHA’s Navigator could then “talk” directly to Paylocity.

“We do not do payroll in our office,” McFarland says, “but we have relationships with providers like Paylocity and Paycor, who are also technology driven and who link up with our human resources systems. We developed our NHA Navigator to streamline the process for our HR managers we work with every day.”

The Navigator allows Reckner to enter employee information just once. It then sends that information to insurance carriers.

The time is past when she would have entered the same employee information into as many as six insurance carrier sites every time Quaker hired or terminated an employee or changed a policy.

“So now I enter it one time and that has streamlined that process,” Reckner says.

“I save hours a day because every day there’s something going on with an employee: an address change, adding a dependent, a termination or they’ve left us or something,” Reckner says. “And that’s a task that has to be done in every one of those systems.”

She considers Paylocity and Navigator as the first steps taken toward eliminating the piles of paper that take up space in the HR department.

“The end goal is to be paperless,” Reckner says, “so that when I’m bringing someone on, I have no paperwork.”

Navigator “systematizes” the data that must be entered and saved when a new employee is hired, she explains. The data include benefits, training, payroll, tracking, managing his election of benefits, payroll deductions and employee notices.

Previously the process took three to four days, Reckner says. Now open enrollment for health insurance can be done in one day and employees can elect their benefits through Navigator.

“It’s a web-based program,” McFarland says. “All the employees are given a user name and password if the employer chooses that route. HR managers, owners and chief financial officer are all given administrative passwords. Then the employees in our office, the National Healthcare account managers have access to that information as well.”

The platform is linked to the insurance carrier’s website and platform, a dramatic change from the earlier practice of entering paper applications into a static database.

Reckner describes the Navigator program, implemented in phases, as “very user-friendly” and cost-efficient. She also likes that it requires little work from her end.

While the client incurs little expense, the technology demanded a substantial investment from National Healthcare Access.

“We at National Healthcare Access have invested substantial money into the technology,” McFarland says, “but because we are first and foremost an employee- benefits broker, we provide the platform at a very discounted rate. It’s not expensive to our clients, but it is a significant investment on the end of National Healthcare Access.”

Today Reckner thinks of NHA as a part of her HR team. McFarland answers any questions she has and helps her stay in compliance. McFarland comes to Quaker to help process new hires and holds educational meetings with employees.

“She and her team are such a huge resource,” Reckner says of McFarland. “I couldn’t appreciate them any more than I do and my access to them.

It’s all an outgrowth of the approach McFarland takes with her clients, she says.

“I’m not an agent who comes in once or twice a year to sell insurance,” McFarland says. “With Teresa and the bulk of my clients, I feel like I’m more of a partner.”

The process that helped Reckner and Quaker Mfg. solve their HR problems is part of an evolution that Dan Caparso, president of National Healthcare Access, began several years ago.

With the passage of the Affordable Care Act and rapid advances in the industry, NHA decided to invest in emerging technologies and become “a tech-driven agency,” Caparso says.

Technology is transforming HR, he continues. “We like to think of ourselves as an extended arm of the HR department. We’ve really seen a shift in the last few years. Our role used to be handling employee benefits and that was it. We’ve become much more than that.”

Along with the Navigator, NHA has a program called HR 360, which Caparso describes as an online HR library. “HR 360 gives our employees access to anything related to human resources,” he says. “It could be benefits, benchmarking salaries or job descriptions or things to be aware of when you’re hiring or firing new employees.”

Another product NHA offers is Form Fire. It allows employees to complete medical applications online and avoid the paper clutter.

NHA’s products are designed for firms with as few as two employees.

Many smaller companies lack a dedicated HR department. For those companies, “We really feel like we are their HR,” Caparso says.

Health care remains one of the biggest issues and major expenses at most companies NHA serves, Caparso says. Helping to keep clients compliant with the Affordable Care Act has become one of its primary responsibilities.

“The Affordable Care Act has really changed everything about our business – the way we conduct ourselves, a lot of new laws, compliance and regulations,” he says.

Seven years since it was passed, companies are still struggling to stay compliant, Caparso says. Keeping employers educated is key to serving them.

Besides educating employers about the mandates of the ACA, National Healthcare Access works to ensure than their employees understand how their health plans works, Caparso says.

NHA now serves more than 700 employer groups, Caparso says, along with an Individual & Medicare department that serves more than 1,000 individuals.

“We try to do as much as we can to support our clients and to support our community, and its not just about providing benefits for HR,” Caparso says. “Unfortunately, insurance is becoming a commodity, so we work hard to make our employers’ lives, and our clients’ lives, a little bit easier.”

Copyright 2024 The Business Journal, Youngstown, Ohio.