$40M GM Clawback Draws Praise; Ultium Tax Credits, Hope

YOUNGSTOWN, Ohio – State and local officials largely hailed the Ohio Tax Credit Authority’s decision to require General Motors to refund $28 million in tax credits it received for its Lordstown plant and to make an additional $12 million investment in the Mahoning Valley.

GM’s decision to cease production at the Trumbull County plant in March 2019 put it in violation of job creation and retention tax credit agreements it entered into in 2008 for which it received $60.3 million in tax credits.

The decision to terminate the two agreements was swiftly applauded by state Attorney General Dave Yost, who in a June 30 brief to the state tax credit authority advocated for clawing back the entire $60 million.

“It’s good news to hear that GM will repay the financial incentives it was offered. Thanks to Gov. DeWine and his team for staying on top of this business relationship and holding them accountable,” Yost said in a statement. “I look forward to seeing the details and watching further business relations flourish in the state.”

Lordstown Mayor Arno Hill said he is glad to see the issue was “winding down.”

Hill said he had spoken with state officials about GM’s impending investments in the community, which include the Ultium Cells battery plant it is jointly developing with South Korea battery manufacturer LG Chem. On Monday the tax credit authority approved a 1.95%, 15-year job creation tax credit for the project.

That investment “should weigh a little bit [on the tax panel’s final decision] and it probably did,” Hill said. “They haven’t totally left so I’m happy. This is another thing we can put to bed.”

How the community support funds will be spent – or how much might go to the village – is “yet to be determined,” Hill said.

Federal and state legislators also weighed in on the tax credit authority’s decisions Monday.

State Sen. Michael Rulli, R-33 Salem, said GM was “trying to make right with this area,” first by providing its former Lordstown plant to Lordstown Motors Corp. at below what it was worth, then with the decision to site the $2.3 billion Ultium Cells plant in Lordstown and by agreeing to the $12 million local investment as part of its agreement with the state.

“They laid out a pathway for the future of this area. The ultimate goal is to turn Voltage Valley into the Silicon Valley of the East,” he said.

“The Valley has been hit hard in the past few years, but we’re home to some of the best workers in the country and we know how to get back up again,” said state Sen. Sean O’Brien, D-32 Bazetta. “We know how to build things and today’s news takes us one step closer to becoming the Voltage Valley: the electric vehicle manufacturing capital of the nation,”

State Rep. Michele Lepore-Hagan, D-58 Youngstown, said she remains unhappy about the jobs lost at the GM Lordstown plant but acknowledged that the automaker ias “stepping up financially to repay some of what Mahoning Valley has given them” through the clawback and the $12 million in community support funds.

“We have to keep pressure on corporations that receive state tax breaks and make sure that they are providing the jobs that were promised instead of packing up and leaving town and taking part of our economy with them,” she said.

“Autoworkers in Ohio are among the best in the world at what they do, and any investment in Ohio workers is a smart investment,” U.S. Sen. Sherrod Brown, D-Ohio, said in an email responding to a request for comment.

“At the same time, we know that GM could have saved the jobs of 4,500 workers at the Lordstown plant by bringing a new vehicle to the plant — and GM’s decision to pay back the tax breaks they received is an admission of their betrayal of Ohio’s workers,” he added.

The GM complex’s closing in 2019 was “a big punch to the gut for this community, especially given the taxpayer dollars that helped incentivize their business” and the tax credit authority’s order to claw back the incentive “should be obeyed,” affirmed U.S. Rep. Tim Ryan, D-13 Ohio.

“I am comforted to see that GM will expectantly commit to investing $12 million in the local community via a variety of mechanisms including education and training, scholarships, education, job training support and infrastructure,” he said.

“Over the years, I’ve supported several transformational projects through my Committee on Appropriations and any possible blending of investments between these parties could help advance key projects and pave the way for generations of economic growth in our region,” he continued. “And with that, GM will be instrumental in their assurance to reinvest in the research, technologies, and workers of this region.”

Tom Humphries, president and CEO of the Youngstown/Warren Regional Chamber, said he believes the decision by state officials was a good one. He was pleased particularly because a portion of the $12 million in community support funds will be dedicated to workforce development.

“That’s always a challenge so I’m glad to see those dollars coming back,” as well as the funds to address infrastructure, he said.

The community also is fortunate to have Ultium Cells coming here, Humphries said. That technology puts the community in a “very good position,” he said.

“We continue to see GM as a very strong partner in our community, and we’re blessed to have that opportunity to continue to work with them.”

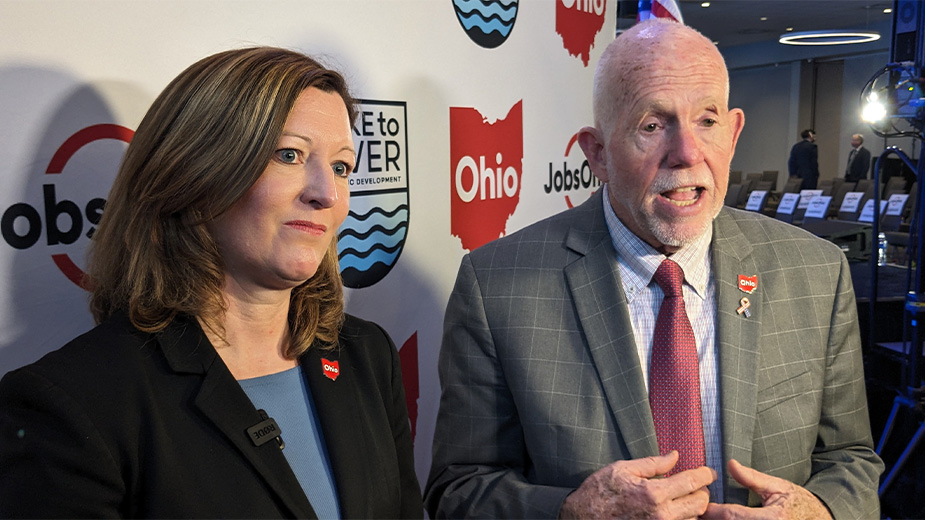

Pictured: The last Chevrolet Cruze rolls off the line at the former GM Lordstown assembly plant in March 2019.

Related coverage:

- Sept. 28 | Tax Authority Says GM Owes $28M for Violating Lordstown Agreement, Must Provide Valley $12 Million

- Sept. 25 | Tax Authority to Look at Incentives for GM Battery Plant, $60M It Owes Ohio

- Aug. 31 | Ohio AG Urges Tax Authority to Vote on GM Decision

- Aug. 31 | Tax Authority Postpones Action on GM Incentives

Copyright 2024 The Business Journal, Youngstown, Ohio.