Your Home, Your Insurance Policy

YOUNGSTOWN, Ohio – No two homes and no two homeowners are alike. So why should their insurance policies be? Now more than ever, home insurance is a tailored product that can be customized in nearly any way the homeowner sees fit.

“We are a data-driven industry. Millions upon millions of data points go into deciding what our rates are going to be,” says David Mollenkopf, an agent with Crabb Insurance Agency in Salem and East Palestine. “Rates are made up of two things: the likelihood of a loss and how much that loss will cost to fix.”

Where it used to be that insurance rates within a neighborhood were largely the same, insurers today are considering dozens of factors to determine a given homeowner’s rate. One carrier, Mollenkopf says, considers as many as 36 factors. Among them are the age of the roof, furnace and water heater and what type of flooring the house has.

Because of state regulations, the basics of many policies – standard losses include weather damage, theft and injuries – are the same across carriers. What separates policies from Company A, Company B and Company C is in those data points and the finer details of coverage.

“The reason each insurance carrier doesn’t offer the exact same rate for the exact same house is there are different weightings on different factors,” Mollenkopf says. “Some put the age of the dwelling as a high factor. Others do your insurance score, which is part of your credit score.”

Adds Rod Strichek, principal at Par Insurance Group in Poland, “What it comes down to is the details. … It’s really about paying attention to the details and making sure you’re covering not only your home but also your contents.”

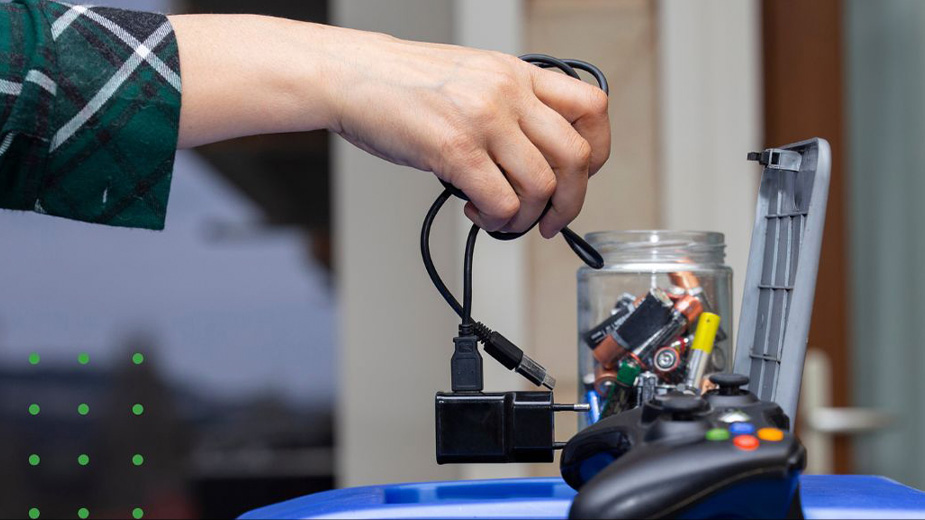

Most policies cover the value of items that are lost, says Nick Rusinowski of The Agent Insurance Services, Boardman. It’s important to keep tabs on the value of possessions, especially those you don’t often consider. If a house is destroyed, the value of trinkets kept packed away in the attic is as important as the replacement cost of the appliances and clothing used daily.

“We have a little notebook to list your personal property,” he says. “I have two kids and my wife. There’s all the furniture, everybody’s clothing, the clothing we don’t wear, the TVs, the toys and all that other stuff we don’t think about.”

While the cost of replacing things such as appliances and furniture are easily calculable, Mollenkopf says items of “unique or valuable nature” should be specially noted in an insurance contract.

“It’s not that we won’t cover them [if they aren’t listed]. It’s that if we don’t know it’s there, we don’t automatically assume it in our rates,” he explains. “If you have a $50,000 Steinway grand piano sitting in the front room, we don’t assume that you have a $50,000 piano. If we don’t know about it, that’s most likely listed as a piece of furniture.”

Among the items that should be considered are items with “more of an inherent value than an explicit value,” he continues, such as jewelry, artwork, instruments or collectible items.

Beyond basic coverage, insurance providers are moving toward an à la carte system of extended protections, as well as bundling additional coverage such as auto insurance into combined packages. “A lot of carriers don’t like to write standalone homeowner’s policies without having the support of the auto. That has a lot to do with weather-driven claims over the years,” Strichek says.

As for the menu-style coverage, homeowners get to tailor their policies to meet the exact needs of their homes. Among the options on the market are earthquake coverage – uncommon in northeastern Ohio, the agents say – flood insurance and home-business protections.

“One of the most important add-ons or coverages to enhance is the backup of sewer and drain,” Strichek says. “That was a huge issue with all the rains we had a couple months ago [in August, that caused flooding throughout Boardman] and we saw a lot of people were under-covered.”

Adds Rusinowksi: “That [add-on] is, on average, about $10 a month for $10,000 in coverage, which covers cleanup from a company that comes in, removes water, remediates damage and deals with any mold problems, as well as any stuff you have there if it’s a finished basement.”

When it comes to weather-related damages, insurers are “getting creative,” Strichek says, in underwriting deductibles. Among the new trends the agents see are split deductibles that place a higher rate on damage caused by hail and wind, which in turn lowers the rate on standard coverage.

“You have your standard deductible and a lot of companies offer you a discount if you agree to a higher deductible on those damages,” Mollenkopf relates, noting such a policy may be a $2,500 deductible for wind and hail damage and $1,000 for all others.

In calculating a homeowner’s rate, insurers consider the cost of rebuilding the house, not its market value, the three agents emphasize. That cost takes into account both labor and materials required to replace a house should the structure be a total loss, making it quite a bit higher than the market value.

Although many insurance carriers are national companies, they operate largely state by state. An earthquake in Alaska won’t have much effect on a house here in Ohio. But that doesn’t mean it has none.

Rusinowski points to the recent wildfires in California. Rebuilding and repairing houses there will tighten up the supply of building materials, driving up prices of lumber.

“If you have a loss here during a catastrophe elsewhere, you might not have sufficient coverage because the labor or materials are inflated,” he says.

With so many factors and coverage possibilities, the agents agree that it’s hard to pin down a typical price of a policy without first seeing the house and meeting with homeowners. That said, they agree rates here are stable and aren’t prone to big swings from year to year.

“Ohio is one of the most competitive states when it comes to rates. I’ve not seen any excessive rate increases because of weather claims,” Strichek says. “There isn’t any major gouging as far as rates go.”

Many policies, Rusinowski adds, do have “inflation guards” built in, usually between 3% and 4%.

“Erie [Insurance Group] two years ago took a rate increase on homes bigger than 2,000 square feet and homes that are a frame build, but generally it’s more due to claims than anything else,” he says. “Every policy that covers property generally has inflation guard built in.”

Especially for first-time homebuyers, what’s most important in deciding on a policy is trust in an agent.

“They trust their accountant, their doctor, their lawyer and they view the information shared with them as sacrosanct,” Mollenkopf says. “Don’t underestimate how much you trust your insurance agent. You’re putting faith in your agent and it’s best for both parties to stay as informed about each other as possible.”

Copyright 2024 The Business Journal, Youngstown, Ohio.